bot ivgn @ 73, sold @ 74.04, net 1%

bot cmtl @ 34.62, sold @ 35.6, net 3%

bot ford @ 16.86, sold @ 16.32, net (3%)

bot talx @ 26.01, sold @ 26.75, net 3%

bot stmp @ 20.1, sold @ 19.55, net (3%)

bot mdrx @ 14.55, sold @ 14.45, net (1%)

bot ntgr @ 16.19, sold @ 16.55, net 2%

bot mcrs @37.79, sold @ 38.96, net 3%

Saturday, April 30, 2005

Friday, April 29, 2005

One thing I do like

That is the volume. Volume is heavier on both exchanges. Besides the dropping energy price, end of monthy mark-up is also contributing this relieve rally. Enjoy it as long as we have it.

Bounce

The market is once again saved by the dropping oil price. Nasdaq is lagging Dow Jones that makes me not like this rally, though I nibbled some longs this morning.

Thursday, April 28, 2005

You bullish on semiconductor? Think again.

Other countries

Morning

Crude oil continues its selloff, now it is holding a minor support at $49.5. But where is out boost for the equity market?

Wednesday, April 27, 2005

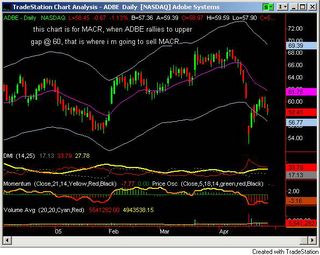

ADBE-MACR combo

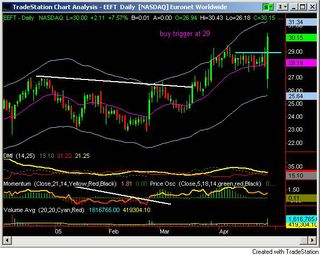

EEFT- I missed it

Crude oil

Crude oil inventory

Dow had a mini rally of 35 pts as crude oil turns south after Inventory data; crude has fallen 1.9% over past 5 minutes.

Morning

This morning I am going to bring my girlfriend to see a eye doctor. There won't be much posts. I will try to get back to market by close. I am stick with selling rally strategy so far.

Tuesday, April 26, 2005

Bear flags

Will the bulls come back in the last hour? This remains to be seen. So far the bear flags I showed in the newsletters are more vivid than ever. I am very disappointed by today's action.

Retreat

The market retreats to the low of the day due to the higher crude oil price. As I said last week, I think crude oil is at resistance and is going to pull back in the near term. Currently I m towards bull camp for the equity market.

NASDAQ leading!

One bullish factor I notice today is NASDAQ is leading the reversal today, which is very bullish. Usually the broad based rally led by technology tends to last.

Morning

According to Briefing.com, "April consumer confidence checked close to consensus estimate of 98.0, marking the third consecutive decline in that metric; however, new home sales for March surged 12.2% to a new record level of 1431K". Not surprisingly, housing sector has been strong, including HOV, BZH, KBH, RYL.

Monday, April 25, 2005

Losing steam

The market is quickly losing steam in the last hour's trading. Lack of the volume is a problem for the bulls. I guess I will have to wait for another day to declare the victory of the bulls.

Weak volume

With major averages are in solid green now, volume is still running at slow pace. I guess most market player are not persuaded yet.

Strong open

The market opened in green with strength across the board. Just like what I have said in last night's newsletter, I am hesitating to initiate short position aggressively. If we can make higher highs, I would say the low is in.

Sunday, April 24, 2005

Past trades for the week April 18th

bot 1000 cern @ 59.11, sold @ 59.93, net 1%, $820

bot 1000 goog @ 216.54, sold @ 217.92, net 1%, $1380

bot 2000 ford @ 15.67, sold @ 16.6, net 6%, $1860

bot 2000 vrsn @ 29.66, sold @ 29.02, net (2%), ($1280)

bot 3000 ndaq @ 12.2, sold @ 14, net 15%, $5400

bot 1000 bste @ 61.39, sold @ 58.72, net (4%), ($2670)

bot 1000 goog @ 215.28, sold @ 217.4, net 1%, $2120

bot 2000 orct @ 21.78, sold @ 22.67, net 4%, $1780

bot 1000 esrx @ 88.21, sold @ 90.02, net 2%, $1810

bot 1000 cern @ 58.09, sold @ 58.49, net 1%, $400

bot 2000 snda @ 31.75, sold @ 32.85, net 3%, $2200

bot 2000 tzoo @ 33.65, sold @ 32.25, net (4%), ($2800)

bot 2000 tzoo @ 33.35, sold @ 33.8, net 1%, $900

bot 1000 affx @ 46.52, sold @ 45.56, net (2%), ($960)

bot 1000 shld @ 137.65, sold @ 138.93, net 1%, $1280

bot 2000 appx @ 58.21, sold @ 56.99, net (2%), ($2440)

bot 1000 uthr @ 48.18, sold @ 49.65, net 3%, $1470

bot 2000 macr @ 37.91, sold @ 38.85, net 2%, $1880

bot 1000 goog @ 216.54, sold @ 217.92, net 1%, $1380

bot 2000 ford @ 15.67, sold @ 16.6, net 6%, $1860

bot 2000 vrsn @ 29.66, sold @ 29.02, net (2%), ($1280)

bot 3000 ndaq @ 12.2, sold @ 14, net 15%, $5400

bot 1000 bste @ 61.39, sold @ 58.72, net (4%), ($2670)

bot 1000 goog @ 215.28, sold @ 217.4, net 1%, $2120

bot 2000 orct @ 21.78, sold @ 22.67, net 4%, $1780

bot 1000 esrx @ 88.21, sold @ 90.02, net 2%, $1810

bot 1000 cern @ 58.09, sold @ 58.49, net 1%, $400

bot 2000 snda @ 31.75, sold @ 32.85, net 3%, $2200

bot 2000 tzoo @ 33.65, sold @ 32.25, net (4%), ($2800)

bot 2000 tzoo @ 33.35, sold @ 33.8, net 1%, $900

bot 1000 affx @ 46.52, sold @ 45.56, net (2%), ($960)

bot 1000 shld @ 137.65, sold @ 138.93, net 1%, $1280

bot 2000 appx @ 58.21, sold @ 56.99, net (2%), ($2440)

bot 1000 uthr @ 48.18, sold @ 49.65, net 3%, $1470

bot 2000 macr @ 37.91, sold @ 38.85, net 2%, $1880

Saturday, April 23, 2005

Weekly commentary

Stocks went on a wild ride this week: five of the past eight trading sessions have seen 100 plus point swings in the Dow. The biggest move was a 206-point leap to the upside on Thursday. This was also the biggest one-day gain in years.

I did some nibbling into last week's rally, but I'm still maintaining very cautious stance. I suspect that that big rally on Thursday was just a technical bounce from an extremely oversold condition, and not a reversal of trend.

Now the question is whether it was the low of the year or just a pause before more downside ahead. Fundamentally, the bulls can argue that operating earnings for the first quarter of 2005 (for the S&P 500) are on track for 12% growth. Just a few weeks ago, the expectation was for 7% growth. Also, guidance for the second quarter has been mostly upbeat. But the bears can respond with following argument.

1. Rising inflation. The March CPI report came out last week, and the core number was +0.4%, twice as bad as expected.

2. An aggressive Fed. They've been raising rates at every meeting for some time now, and more hikes are expected.

3. A falling stock market. In spite of Thursday's rally, the trend is still down.

4. Oil prices are once again on the rise. Last week, crude oil futures jumped from $50.49 to $55.39, a 9.7% gain.

5. About that big stock rally on Thursday: The volume that day was not consistent with a major change of market direction.

In my view, the negatives outweigh the positives here. I remain bearish. However, I am also very much on the lookout for technical signs of an important market bottom.

I did some nibbling into last week's rally, but I'm still maintaining very cautious stance. I suspect that that big rally on Thursday was just a technical bounce from an extremely oversold condition, and not a reversal of trend.

Now the question is whether it was the low of the year or just a pause before more downside ahead. Fundamentally, the bulls can argue that operating earnings for the first quarter of 2005 (for the S&P 500) are on track for 12% growth. Just a few weeks ago, the expectation was for 7% growth. Also, guidance for the second quarter has been mostly upbeat. But the bears can respond with following argument.

1. Rising inflation. The March CPI report came out last week, and the core number was +0.4%, twice as bad as expected.

2. An aggressive Fed. They've been raising rates at every meeting for some time now, and more hikes are expected.

3. A falling stock market. In spite of Thursday's rally, the trend is still down.

4. Oil prices are once again on the rise. Last week, crude oil futures jumped from $50.49 to $55.39, a 9.7% gain.

5. About that big stock rally on Thursday: The volume that day was not consistent with a major change of market direction.

In my view, the negatives outweigh the positives here. I remain bearish. However, I am also very much on the lookout for technical signs of an important market bottom.

Friday, April 22, 2005

Downtrend

None of the major averages reversed yet. We are still in a firm downtrend. Yesterday was just a big bounce in a downtrend so far.

Crude oil

Crude oil future is up over $55 a barrel this morning that is one of the reasons, besides profit taking, keeping the market from rally. I think crude oil is hitting short term resistance and any pullback will help us continue yesterday's momentum.

Market mildly pull back

There is nothing wrong with this short term pullback. If we only get such small profit taking, bears will feel much nervous and will be forced to cover more in the afternoon. And bulls will be much bolder.

Thursday, April 21, 2005

My thought on the market heading tomorrow

I am about to turn bullish, but not yet. I am not bullish until internet sector (INX) captures 189. It closed at 186.9 today. If it is indeed a bear trap, the sectors I am going to focus on are internet and biotech.

Adding more longs

As this rally gets stronger, I become longer and longer. Now I am 100% long, including SNDA, ESRX, CERN, MACR(ADBE).

Explosion

Market exploded after the Philadelphia Fed report. I am adding some longs and watching it very closely. It is still possible we will have sharp pull back in the afternoon.

Remember bear market behavior?

Sharp rally in the morning, sell off in the afternoon? This is what I am afraid now. Not buying this rally.

Wednesday, April 20, 2005

Sentiment

A different view on the sentiment. Just some food for thought.

http://www.decisionpoint.com/TAC/KATZ.html

http://www.decisionpoint.com/TAC/KATZ.html

Subscribe to:

Comments (Atom)