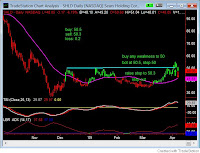

$2 loss, possbile $12 loss.

$2 loss, possbile $12 loss.

Friday, April 28, 2006

Thursday, April 27, 2006

Wednesday, April 26, 2006

Monday, April 24, 2006

After hour

NFLX, ZRAN both report strong numbers, shares are on fire in the after hour trading. I recommended them in my newsletter couple of days ago.

One bright spot

Last night, Japanese and Korean stock market both had some severe selloff. I thought it was going to spread to us. Having that in mind, we hold it pretty well.

Morning

I am disappointed by the weak action after last Tuesday's strong rally, I sold some of my holdings, though I remain mildly bullish.

Friday, April 21, 2006

Thursday, April 20, 2006

ZONA

Update: FFIV

http://uclatrader.blogspot.com/2006/04/ffiv.html

Remember my short recommendation FFIV? It drops to $56 after hour. Too bad I do not have it.

Remember my short recommendation FFIV? It drops to $56 after hour. Too bad I do not have it.

Buying opportunity

The market is pulling back this morning, which creates a buying opportunity for the traders who did not have chances in the last couple of days. The Material sector is getting sold off today, the momentum money now may rotate into the technology stocks.

Tuesday, April 18, 2006

The Fed

The Fed says that they are going to stop raising the interest rate soon. This fundamental bullish news changes the outlook of the stock market entirely, even though it was on the edge of breaking down last night. The heavy volume tells us that this is not a one day wonder, we have more upside in the future.

Crazy

This market can really turn on a dime. Yesterday we were close to break down, today the Banks lead us back to buy signal, only if we close like this right now. I don't have CNBC or Bloomberg, so I have no idea what is the big news behind this crazy action. And honestly I don't want to hear it either. Let those people on TV worry about how to spin it. But remember, we have YHOO, AMGN, CYMI, GILD, MOT, TXN to report numbers this afternoon. As I said, the market could really turn on a dime, EITHER WAY.

Monday, April 17, 2006

Lagging performance

Before I go to bed, I checked the Asian stock market that is a routine for me for many years. Most of them are up big tonight, especially the Indian market. I know that US market has been lagging for months, but if we break down this week, I have to say that we F*CKING SUCK.

Dangerous to break down

Today's action is bearish no matter how I paint it, especially right before the earning season. Any earning that not good enough will ignite a technical melt down.

Sunday, April 16, 2006

Accelerating momentum strategy

http://www.tigersharktrading.com/articles/2053/1/

Trading-Stock-Setups-with-the-Accelerating-Momemtum-Strategy

In this video, Dave Landry teaches us a way to catch the explosive move. Very good stuff.

Trading-Stock-Setups-with-the-Accelerating-Momemtum-Strategy

In this video, Dave Landry teaches us a way to catch the explosive move. Very good stuff.

Trading system

http://www.tigersharktrading.com/articles/2560/1/

Advantages-and-Disadvantages-of-Different-Trading-Systems

Price Headley talks about trading systems in this article. Members who have followed me long enough know that I don't apply many different trading systems. To trade successfully, you only need one or two.

The systems I use the most are breakout and pullback.

Advantages-and-Disadvantages-of-Different-Trading-Systems

Price Headley talks about trading systems in this article. Members who have followed me long enough know that I don't apply many different trading systems. To trade successfully, you only need one or two.

The systems I use the most are breakout and pullback.

Realmoney barometer

One thing I like Realmoney.com is their weekly sentiment poll. Although it is not as well known as other sentiment indicators, it tracks the greed and the fear pretty well. Besides, the direction of a sentiment indicator is more important than its overbought or oversold readings, because an extreme reading can go to even more extreme. So most of time I am only looking at the direction.

Saturday, April 15, 2006

Mutual fund poll

I created a poll to the right, please do me a favor vote it if you invest in mutual funds. Because I personally think mutual fund is a BIG LIE, which the institutions use as a tool to take money from small investors. I would rather put the money in a CD or just spend it. Maybe I am wrong, maybe I am an extremist, let's see the poll result.

Thursday, April 13, 2006

Mini rally

This morning we are having a Semi-led rally, so far so good. The key is this afternoon, when the sellers are supposed to coming in. Besides, tomorrow is holiday. Let's see if we can hold the gain. If it does, maybe the rally can carry over to the next week. In conclusion, don't be excited yet.

Wednesday, April 12, 2006

Dell monitor

Why I like to play "breakout"?

http://www.activetradermag.com/special/

cyber06april1.htm

This author investigates 20 day breakout patterns in the S&P 500 tracking stock (SPY) since 1993. Many traders monitor 20-day breakouts, but is it really working?

In the end, he concluded "Overall, the performance after new 20-day highs and lows underscores the stock market’s upward bias. Breakouts above 20-day highs were more likely to be followed by continued gains than losses, while "breakdowns" below 20-day lows were more likely to be followed by upside reversals. The market’s initial tendency to rebound off lows is a broad pattern we’ve found in previous studies."

cyber06april1.htm

This author investigates 20 day breakout patterns in the S&P 500 tracking stock (SPY) since 1993. Many traders monitor 20-day breakouts, but is it really working?

In the end, he concluded "Overall, the performance after new 20-day highs and lows underscores the stock market’s upward bias. Breakouts above 20-day highs were more likely to be followed by continued gains than losses, while "breakdowns" below 20-day lows were more likely to be followed by upside reversals. The market’s initial tendency to rebound off lows is a broad pattern we’ve found in previous studies."

Tuesday, April 11, 2006

Update: SHLD

Monday, April 10, 2006

Market

The market continues its slide, our tech leader-the Networking index is down 1.3%. I am selling my long positions, back to caution mode.

Friday, April 7, 2006

Pullback

This pullback is harsh, is shaking the trees. Are bulls jumping off the ship? I would like to see some bounce before the close.

To the new traders

Listen, you WILL pay tuition to learn how to trade. You will either pay it to the markets or to an educational teacher. My advice, get the education first. That way, it is much less painful to the ego and to the pocketbook. An educational firm or a teacher costs you a couple of thousand dollars, a single trade can cost you that and you will encounter numerous such trades before you become successful. I just wish someone had told me that before I spent years losing money until I discover my winning trading system. So please don't walk the hard way.

Thursday, April 6, 2006

The Kirk Report

There are some good points made by Charles Kirk yesterday about trading. "none of these successful people have ever relied on others for stock picks or investment advice to make their fortunes. All successful investors and traders must discover that you have to make your own fortune in the market......To find success in the market, you must understand, know, and fully appreciate the fact that you must develop your own strategy and approach to the market......In the end, the absolute largest obstacle in the way of most individual traders and investors is that they must realize that there are no short cuts to success."

The above is very important to the new traders. You will fully understand it when you can trade for living one day. On the other hand, Kirk, you should really concentrate on your trading. I am sort of disappointed by your last year's performance. With $700,000 in your account, the return was not that impressive. Hope you do much better this year!

The above is very important to the new traders. You will fully understand it when you can trade for living one day. On the other hand, Kirk, you should really concentrate on your trading. I am sort of disappointed by your last year's performance. With $700,000 in your account, the return was not that impressive. Hope you do much better this year!

My previous comment on the market

From the following link, you could tell my prediction on the market is right on!!!

http://uclatrader.blogspot.com/2006/04/

semiconductors.html

http://uclatrader.blogspot.com/2006/04/

semiconductors.html

Subscribe to:

Comments (Atom)